Microelectronics world news

Solid Q2 FY 2024. Prolonged weak demand in major target markets leads to a lowering of the forecast for the fiscal year. Program to strengthen competitiveness starts.

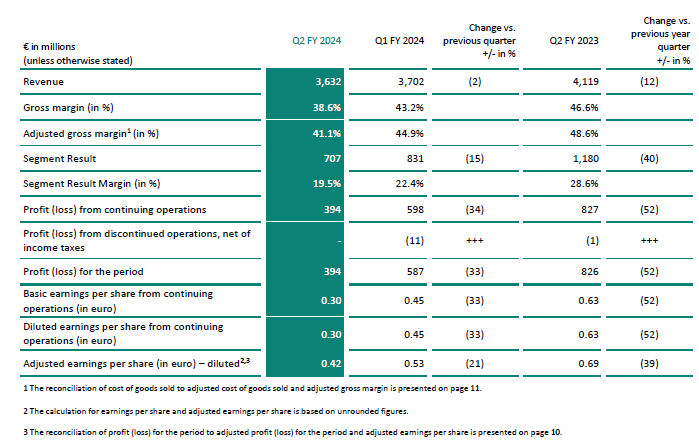

– Q2 FY 2024: Revenue €3.632 billion, Segment Result €707 million, Segment Result Margin 19.5 percent

– Outlook for FY 2024: Based on an assumed exchange rate of US$1.10 to the euro, Infineon now expects to generate revenue of around €15.1 billion plus or minus €400 million (previously €16 billion plus or minus €500 million), with a Segment Result Margin of around 20 percent (previously in the low to mid-twenties percentage range) at the mid-point of the guided revenue range. Adjusted gross margin will be in the low-forties percentage range (previously in the low to mid-forties percentage range). Investments are planned at around €2.8 (previously around 2.9 billion). Adjusted Free Cash Flow of about €1.6 billion (previously €1.8 billion) and reported Free Cash Flow of about €0 million (previously about €200 million) are now expected

– Outlook for Q3 FY 2024: Based on an assumed exchange rate of US$1.10 to the euro, revenue of around €3.8 billion expected. On this basis, the Segment Result Margin is forecast to be in the high-teens percentage range

Infineon Technologies AG is reporting results for the second quarter of the 2024 fiscal year (period ended 31 March 2024).

„In the prevailing difficult market environment, Infineon delivered a solid second quarter”, says Jochen Hanebeck, CEO of Infineon. “Many end markets have remained weak due to economic conditions, while customers and distributors have continued to reduce semiconductor inventory levels. Weak demand for consumer applications persists. There has also been a noticeable deceleration in growth in the automotive sector. We are therefore taking a cautious approach to the outlook for the rest of the fiscal year and are lowering our forecast. In the medium to long term, decarbonization and digitalization will continue to be strong structural drivers of our profitable growth. In order to realize the full potential of our Company, we will further strengthen our competitiveness. To this end, we are launching the company-wide “Step Up” program. We are aiming to achieve structural improvements in our Segment Result in the high triple-digit million euro range per year.”

Group performance in the second quarter of the 2024 fiscal yearIn the second quarter of the 2024 fiscal year, Infineon generated Group revenue of €3,632 million. This was 2 percent down on revenue in the prior quarter of €3,702 million. In the Automotive (ATV) segment, revenue remained stable compared with the prior quarter, while in the Green Industrial Power (GIP) and Power & Sensor Systems (PSS) segments revenue was lower. The Connected Secure Systems (CSS) segment saw a slight increase in revenue from the first quarter of the 2024 fiscal year.

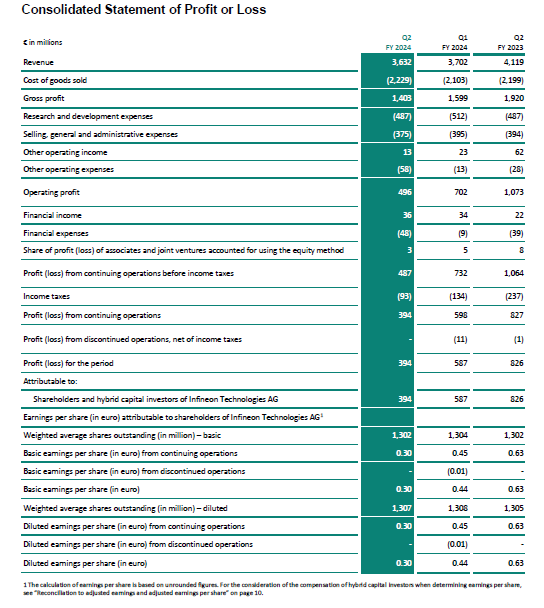

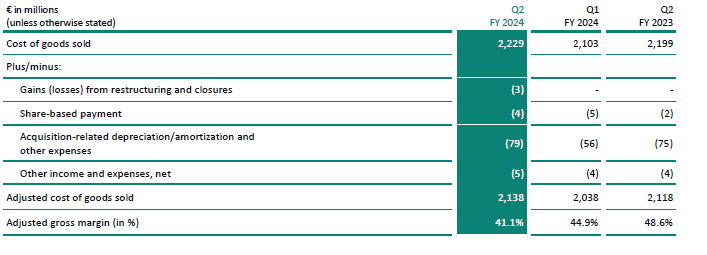

The gross margin achieved in the second quarter of the current fiscal year was 38.6 percent, compared with 43.2 percent in the prior quarter. The adjusted gross margin was 41.1 percent, compared with 44.9 percent in the first quarter of the fiscal year.

The Segment Result in the second quarter of the 2024 fiscal year was €707 million, compared with €831 million in the prior quarter. The Segment Result Margin achieved was 19.5 percent, compared with 22.4 percent in the first quarter.

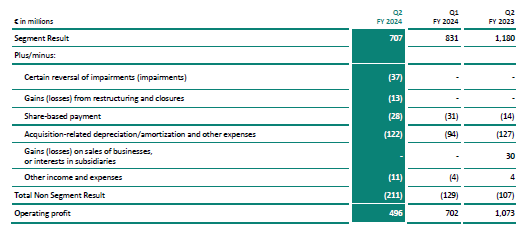

The Non-Segment Result for the second quarter of the 2024 fiscal year was a net loss of €211 million, compared with a net loss of €129 million in the prior quarter. The second-quarter Non-Segment Result comprised €91 million relating to cost of goods sold, €18 million relating to research and development expenses and €54 million relating to selling, general and administrative expenses. In addition, it included net operating expenses of €48 million. This figure includes impairment losses of €37 million relating to the write-down of assets in connection with the planned sale of two backend manufacturing sites in Cheonan (South Korea) and Cavite (Philippines).

Operating profit for the second quarter of the 2024 fiscal year reached €496 million, compared with €702 million in the prior quarter.

The financial result in the second quarter of the current fiscal year was a net loss of €12 million, compared with a net gain of €25 million in the prior quarter. The financial result for the first quarter included interest income of €32 million arising on the release of a tax risk provision in conjunction with the acquisition of Cypress.

The tax expense in the second quarter of the 2024 fiscal year amounted to €93 million, compared with €134 million in the prior quarter.

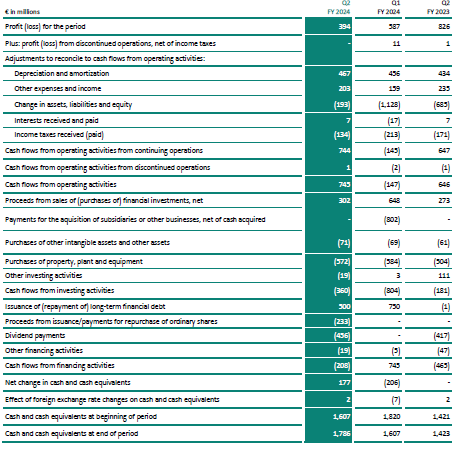

Profit from continuing operations in the second quarter of the current fiscal year was €394 million, compared with €598 million in the first quarter. The result from discontinued operations was €0 million, after a loss of €11 million in the preceding quarter. The profit for the period achieved in the second quarter of the current fiscal year was €394 million. In the first quarter of the 2024 fiscal year, the profit for the period was €587 million.

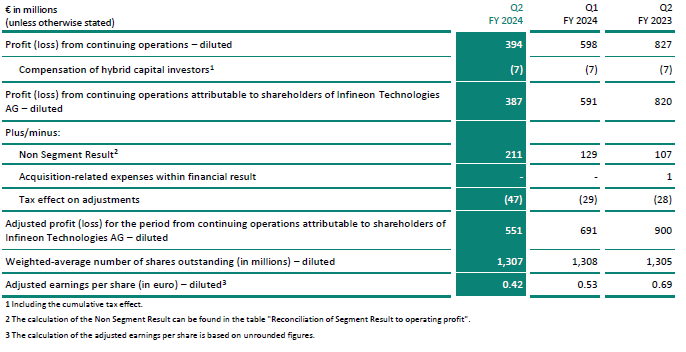

Earnings per share from continuing operations decreased in the second quarter of the 2024 fiscal year to €0.30, from €0.45 in the prior quarter (basic and diluted in each case). Adjusted earnings per share1 (diluted) stood at €0.42 at the end of the second quarter of the current fiscal year, compared with €0.53 one quarter earlier.

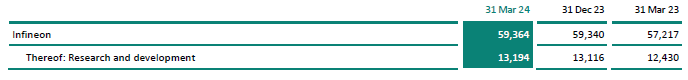

Investments – which Infineon defines as the sum of investments in property, plant and equipment, investments in other intangible assets and capitalized development costs –totaled €643 million in the second quarter of the current fiscal year, compared with €653 million in the first quarter. Depreciation and amortization in the second quarter of the 2024 fiscal year amounted to €467 million, compared with €456 million in the preceding quarter.

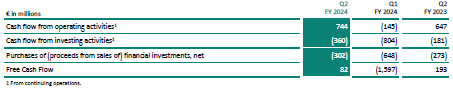

Free Cash Flow2 improved in the second quarter of the current fiscal year to €82 million, compared with a negative figure of €1,597 million in the prior quarter. The figure for the first quarter of the 2024 fiscal year included purchase price payments of around €800 million relating to the acquisition of companies, mainly the acquisition of GaN Systems Inc. Annual bonus payments were also made in the first quarter of the 2024 fiscal year for the record 2023 fiscal year.

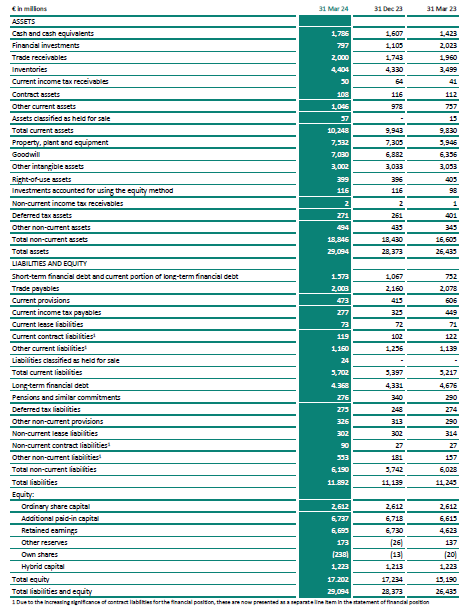

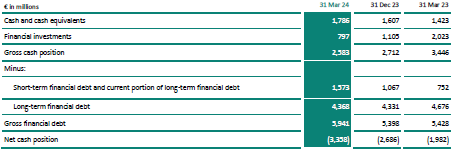

The gross cash position decreased from €2,712 million at the end of the first quarter of the 2024 fiscal year to €2,583 million at the end of the second quarter. In the course of the second quarter, the dividend of €456 million was paid and €233 million was utilized to buy back own shares related with the employee stock option plan. Set against this was the issue of a €500 million bond. Financial debt at 31 March 2024 stood at €5,941 million, compared with €5,398 million at 31 December 2023. The net cash position was therefore a negative amount of €3,358 million, compared with a negative amount of €2,686 million at the end of the first quarter.

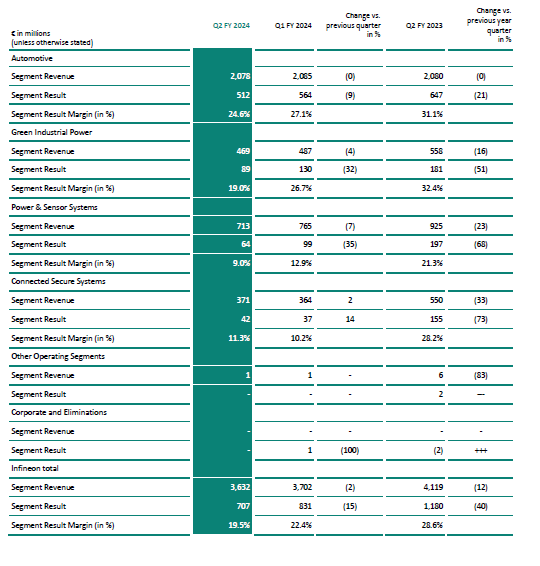

Segment earnings for the second quarter of the 2024 fiscal yearATV segment revenue remained stable in the second quarter of the 2024 fiscal year, totaling €2,078 million, compared with €2,085 million in the first quarter. Set against increasing revenues in electromobility was a slightly lower level of revenue from ADAS. Revenue from classical car components was unchanged. The Segment Result in the second quarter of the current fiscal year was €512 million, compared with €564 million in the first quarter of the 2024 fiscal year. The Segment Result Margin achieved was 24.6 percent, compared with 27.1 percent in the prior quarter.

In the second quarter of the 2024 fiscal year, GIP segment revenue decreased by 4 percent to €469 million, compared with €487 million in the first quarter. As a result of high direct customer and distributor inventory, demand in the areas of renewable energy and energy infrastructure was weaker. The Segment Result in the second quarter of the current fiscal year amounted to €89 million, compared with €130 million in the first quarter of the 2024 fiscal year. The Segment Result Margin was 19.0 percent, compared with 26.7 percent in the prior quarter.

PSS segment revenue decreased in the second quarter of the 2024 fiscal year by 7 percent to €713 million, compared with €765 million in the prior quarter. The reason for the decline in revenue was ongoing weak demand for components for PCs, notebooks, consumer electronics, battery-powered devices and microinverters for roof-top solar systems. Revenue from silicon microphones and components for smartphones continued to recover. The Segment Result achieved in the second quarter of the current fiscal year was €64 million, compared with €99 million in the first quarter. The Segment Result Margin was 9.0 percent, compared with 12.9 percent in the prior quarter.

CSS segment revenue increased slightly in the second quarter of the 2024 fiscal year to €371 million, up from €364 million in the first quarter. The growth in revenue of 2 percent was mainly the result of a higher level of sales relating to Wi-Fi. The Segment Result rose to €42 million, from €37 million in the prior quarter. The Segment Result Margin increased to 11.3 percent, from 10.2 percent in the first quarter.

Outlook for the 2024 fiscal yearBased on an assumed exchange rate of US$1.10 to the euro, revenue in the 2024 fiscal year is now expected to be around €15.1 billion plus or minus €400 million (previously €16 billion plus or minus €500 million). The adjustment of the forecast for the fiscal year is due to prolonged weak demand in major target markets as well as ongoing destocking at direct customers and distributors.

In the Automotive segment, revenue growth in the low to mid-single-digit percentage range is now expected. The decrease in revenue in the Green Industrial Power segment in comparison with the prior fiscal year is expected to be a low-teens percentage figure. The decline in revenue in Power & Sensor Systems is forecast to be in the high-teens and in the Connected Secure Systems segment in the low-twenties percentage range. With expected revenue in the 2024 fiscal year of €15.1 billion, the adjusted gross margin should be in the low-forties percentage range and the Segment Result Margin is expected to be around 20 percent. The Segment Result Margin for the Automotive segment is expected to be at the lower end of the aforementioned range of between 25 and 28 percent.

Investments – which Infineon defines as the sum of investments in property, plant and equipment, investments in other intangible assets and capitalized development costs – are now being slightly adjusted to a figure of about €2.8 billion (previously about 2.9 billion) for the 2024 fiscal year. The focus here will be investments in the manufacturing module at the Kulim site (Malaysia), which is designed to produce compound semiconductors, as well as the manufacturing module in Dresden (Germany), designed to produce analog/mixed-signal components.

Depreciation and amortization are anticipated to be around €1.9 billion in the 2024 fiscal year, of which around €400 million is attributable to amortization of purchase price allocations arising mainly from the acquisition of Cypress. Adjusted Free Cash Flow, which is adjusted for investment in large frontend buildings and the purchase of GaN Systems, is now expected to be about €1.6 billion (previously €1.8 billion), which is about 11 percent of the forecast revenue for the year of €15.1 billion. Reported Free Cash Flow should be around €0 million (previously €200 million). Return on Capital Employed (RoCE) is now forecast to reach around 9 percent. When the figures for Q1 FY 2024 were published, RoCE for the 2024 fiscal year was expected to be around 11 percent.

Outlook for the third quarter of the 2024 fiscal yearBased on an assumed exchange rate of US$1.10 to the euro, Infineon expects to generate revenue of around €3.8 billion in the third quarter of the 2024 fiscal year. Revenue in the ATV and CSS segments should grow in-line with group average quarter-on-quarter. Quarter-on-quarter growth rate for the GIP segment is expected to be belowand for PSS beyond group average. Based on this revenue forecast for the Group, the Segment Result Margin should be in the high-teens percentage range.

Structural improvement program “Step Up” to strengthen competitivenessThe Company wants to further strengthen its competitiveness. To this end, Infineon is starting the “Step Up” program focusing on a targeted, sustainable improvement of its cost structure. The program includes various packages of measures focusing on the areas of manufacturing productivity, portfolio management, pricing quality and operating cost optimization without compromising the Company’s innovative strength.

The program is expected to have a positive effect on the Segment Result in the high triple-digit million euro range per year (based on the 2023 fiscal year). The first financial benefits are expected in the course of the 2025 fiscal year. The full effect is expected to show in the first half of the 2027 fiscal year.

Telephone press conference and analyst telephone conferenceThe Management Board of Infineon will host a telephone press conference with the media at 8:00 am (CEST), 2:00 am (EDT). It can be followed over the Internet in both English and German. In addition a telephone conference call including a webcast for analysts and investors (in English only) will take place at 9:30 am (CEST), 3:30 am (EDT). During both calls, the Infineon Management Board will present the Company’s results for the second quarter of the 2024 fiscal year as well as the outlook for the third quarter and the 2024 fiscal year. The conferences will also be available live and for download on Infineon’s website at www.infineon.com/investor

The Q2 Investor Presentation is available (in English only) at:

https://www.infineon.com/cms/en/about-infineon/investor/reports-and-presentations/

The following financial data relates to the second quarter of the 2024 fiscal year ended 31 March 2024 and the corresponding prior quarter and prior year period.

Revenues, Results and Margins of the SegmentsSegment Result is defined as operating profit excluding certain net impairments and reversal of impairments, the impact on earnings of restructuring and closures, share-based payment, acquisition-related depreciation/amortization and other expense, impact on earnings of sales of businesses or interests in subsidiaries, and other income (expense).

Reconciliation of Segment Result to operating profit Reconciliation to adjusted earnings and adjusted earnings per share – dilutedEarnings per share in accordance with IFRS are influenced by amounts relating to purchase price allocations for acquisitions (in particular Cypress), as well as by other exceptional items. To enable better comparability of operating performance over time, Infineon computes adjusted earnings per share (diluted) as follows:

Adjusted profit (loss) for the period and adjusted earnings per share (diluted) should not be seen as a replacement or superior performance indicator, but rather as additional information to the profit (loss) for the period and earnings per share (diluted) determined in accordance with IFRS.

Reconciliation to adjusted cost of goods sold and gross marginThe cost of goods sold and the gross margin in accordance with IFRS are influenced by amounts relating to purchase price allocations for acquisitions (in particular Cypress) as well as by other exceptional items. To enable better comparability of operating performance over time, Infineon computes the adjusted gross margin as follows:

Adjusted cost of goods sold and the adjusted gross margin should not be seen as a replacement or superior performance indicator, but rather as additional information to cost of goods sold and the gross margin determined in accordance with IFRS.

Number of employees Consolidated Statement of Financial Position Consolidated Statement of Cash Flows Gross and Net Cash PositionThe following table shows the gross cash position and the net cash position. Since some liquid funds are held in the form of financial investments which for IFRS purposes are not classified as cash and cash equivalents, Infineon reports on its gross and net cash positions in order to provide investors with a better understanding of its overall liquidity situation. The gross and net cash positions are determined as follows from the Consolidated Statement of Financial Position:

Free Cash FlowInfineon reports the Free Cash Flow figure, defined as cash flows from operating activities and cash flows from investing activities, both from continuing operations, after adjusting for cash flows from the purchase and sale of financial investments. Free Cash Flow serves as an additional performance indicator, since Infineon holds part of its liquidity in the form of financial investments. This does not mean that the Free Cash Flow calculated in this way is available to cover other disbursements, as dividends, debt-servicing obligations and other fixed disbursements have not been deducted. Free Cash Flow should not be seen as a replacement or as a superior performance indicator, but rather as a useful item of information in addition to the disclosure of the cash flow reported in the Consolidated Statement of Cash Flows, and as a supplementary disclosure to other liquidity performance indicators and other performance indicators determined in accordance with IFRS. Free Cash Flow is derived as follows from the Consolidated Statement of Cash Flows:

Condensed Consolidated Statement of Cash Flows D I S C L A I M E R

D I S C L A I M E R

This press release contains forward-looking statements about the business, financial condition and earnings performance of the Infineon Group.

These statements are based on assumptions and projections resting upon currently available information and present estimates. They are subject to a multitude of uncertainties and risks. Actual business development may therefore differ materially from what has been expected. Beyond disclosure requirements stipulated by law, Infineon does not undertake any obligation to update forward-looking statements.

Due to rounding, numbers presented throughout this press release and other reports may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

All figures mentioned in this press release are unaudited.

The post Solid Q2 FY 2024. Prolonged weak demand in major target markets leads to a lowering of the forecast for the fiscal year. Program to strengthen competitiveness starts. appeared first on ELE Times.

Kubos adds $2m investment to double red micro-LED efficiency for AR/VR displays

Analog Telephone Ringer circuit

| submitted by /u/BOWBUB [link] [comments] |

Not a smartwatch

Not a smartwatch

Hi there

I am searching for a watch that has some GPS and walkie talkie function – and NO MORE. I don’t want a smartwatch with all bells and whistles. Just GPS tracking and some form of talk function. That’s all. Not even SMS.

Not sure if that exists. But if you can help me find this product that would be awesome!

Thanks

[link] [comments]

Inductor Roundup: 3 New Inductors Boost Efficiency in Power Converters

New Vitrimer PCBs Can Be Recycled Many Times Over

James Hitchcock at Tektronix explains the recent EA acquisition

An interview with James Hitchcock, a general manager of Keithley Instruments a Tektronix Company, shed light upon the recent acquisition of Elektro-Automatik (EA), a supplier of high-power electronic test solutions.

EA’s principal application space lies in energy storage, mobility, hydrogen, and renewable energy applications where their bidirectional programmable DC power supplies can double up as both the power supply and electronic load with their unique regenerative feature and bidirectionality. Many tests involve the necessity to dump large amounts of power in the form of heat through passive/resistive load banks or electronic loads, including battery cycling and burn-in tests. On a massive scale, handling this amount of heat is a significant undertaking, where the proper HVAC and even liquid cooling may be necessary. Instead, EA power supplies take that energy and transfer it back to the grid, recycling otherwise wasted energy and eliminating any cooling costs (Figure 1).

Figure 1: The process of energy recovery for EA’s regenerative bidirectional programmable power supplies in a testing scenario connected with the unit under test (UUT). Source: EA, a Tektronix Company

The principal application space for many Tektronix instruments lie in signal integrity and precision high frequency testing with an offering of high-end mixed signal oscilloscopes, signal generators, and spectrum analyzers. Keithley source measure units (SMUs), and precision measure instruments offer solutions for semiconductor characterization and quality control. Outside of this, the MSO oscilloscopes and IsoVu probes are geared towards power electronics performance analysis. However, how does any of this mix with EA’s high power test equipment portfolio?

Test solutions for the EV powertrain

“The primary motivation for acquiring EA and combining the solutions of Tektronix was focused around the battery emulation capabilities of EA and the applications focused on power inverters and motor drives primarily in the automotive space” says James, “where the EA sources can test the batteries but also emulate them in the designs of the vehicles and the Tektronix 4 and 5 series MSO scopes are well-suited for the AC signal analysis to drive the motor that is powered by these battery systems”. As shown in Figure 2, select EA power supplies can simulate a set of battery cells at a specific state of charge (SOC) in a few minutes. Typically, these tests involve hours of preparation, charging and discharging multiple batteries and different SOCs before beginning DUT validation.

Figure 2: The ability to both source and sink power enables EA’s power supplies to simulate battery behavior and accurately reproduce a battery’s voltage and current characteristics to test devices.

The Keithley data acquisition (DAQ) systems and digital multimeters (DMM) have played a role in this space for many years, monitoring the temperature and voltage control of the batteries in battery management systems (Figure 3). “So across the entire engineering workflow of designing the powertrain for an EV the Tektronix-, Keithley-, and EA-branded products work together for a solution.”

Figure 3: Keithley DAQ systems have long been leveraged in environmental monitoring, burn-in/accelerated life testing, as well as failure analysis for automotive applications. Source: Keithley, a Tektronix company

Power inverter and fuel cell testing

“There are other opportunities in power inverters in renewables, especially converting voltage from the DC side with solar panels to AC,” says James. The testing space expands beyond this with fuel cells testing for heavier duty electric mobility solutions such as large trucks, construction equipment, trains, and boats. Fuel cells are also increasingly used in energy security, providing a backup source of power in the event a black out or brownout occurs. “This is an area that EA is very good at and Tektronix can get involved in designing the precision electronics needed to control this type of testing.”

A gap in market for a unified testing solution

“Our Keithley source measurement units (SMUs) are well-suited to individual cell design,” says James “Our sourcing capabilities with our SMUs stop at about 5 kW of power (Figure 4). We have a 300 V solution and several hundred amp pulsing solutions with our SMUs and we found engineers were moving to higher powers with the evolution of new battery chemistries, new drive trains, and motors.”

Figure 4: The Keithley 2650 series SMU is a high power instrument designed for characterizing high power electronics such as diodes, FETs, IGBTs, etc., with up to 3000 V or 2000 W of pulse current power. Source: Keithley, a Tektronix company

Tektronix intends to support this trend of moving to higher voltage electrification system in EVs and more energy dense battery chemistries to reach parity with internal combustion engineer (ICE) vehicles, “there was a gap in the market where the suppliers were offering the power solutions or the measurement solutions but no one was really offering the full capability to serve the engineer across that full power portfolio”.

In the near term, Tektronix intends to bring the EA products into their software umbrella, providing unified testing solutions for engineers across the power spectrum from low-power embedded IoT designs to ultra-high power energy storage, mobility, and hydrogen fuel applications.

Aalyia Shaukat, associate editor at EDN, has worked in the design publishing industry for eight years. She holds a Bachelor’s degree in electrical engineering from Rochester Institute of Technology, and has published works in EE journals and trade magazines.

Related Content

- Analog or digital: Choose your oscilloscope inputs

- Review: Tektronix RSA306 spectrum analyzer (part 1)

- Tektronix MDO4000 oscilloscopes go multifunction

- Charging batteries rapidly and safely

The post James Hitchcock at Tektronix explains the recent EA acquisition appeared first on EDN.

Infineon introduces PSoC 4 HVPA-144K microcontroller for automotive battery management systems

With the introduction of the PSoC 4 High Voltage Precision Analog (HVPA)-144K microcontroller, Infineon Technologies AG addresses the automotive battery management sector by integrating high-precision analog and high-voltage subsystems on a single chip. It provides a fully integrated embedded system for monitoring and managing automotive 12 V lead-acid batteries, which is critical for the 12 V power supply of vehicles’ electrical systems. The new microcontroller is ISO26262 compliant, enabling compact and safe intelligent battery sensing and battery management in modern vehicles.

The PSoC 4 HVPA-144K’s dual high-resolution sigma-delta ADCs, together with four digital filtering channels, enable accurate measurement of the battery’s state-of-charge (SoC) and state-of-health (SoH) by measuring key parameters such as voltage, current, and temperature with an accuracy of up to ±0.1 percent. The device features two programmable gain amplifiers (PGAs) with automatic gain control, allowing fully autonomous control of the analog front end without software intervention. The use of shunt-based current sensing for batteries provides a higher accuracy than conventional Hall sensors.

An integrated 12 V LDO (42 V tolerant) allows the device to be supplied directly from the 12 V lead-acid battery without the need for an external power supply. An integrated transceiver allows direct communication with the LIN bus. The product meets the functional safety requirements of ASIL-C according to ISO26262.

The Arm® Cortex®-M0+ MCU on which the PSoC 4 HVPA-144K is based operates at up to 48 MHz with up to 128 KB of code flash, 8 KB of data flash and 8 KB of SRAM, all with ECC. The PSoC 4 HVPA-144K also includes digital peripherals such as four timers/counters/PWMs and a serial communication block that can be configured as an I2C/SPI/UART.

The PSoC 4 HVPA-144K is supported by automotive-quality software. Infineon’s Automotive Peripheral Driver Library (AutoPDL) and Safety Library (SafeTlib) are developed according to the standard automotive software development process. They are both A-SPICE compliant, following the MISRA 2012 AMD1 and CERT C, and ISO26262 compliant.

With the introduction of the PSoC 4 HVPA-144K, Infineon is laying the foundation to expand its PSoC microcontroller portfolio to include Li-ion battery management systems for EVs. The portfolio will soon include several products for monitoring and managing high voltage (400 V and above) and low voltage (12 V/48 V) batteries, further facilitating future EV adoption.

AvailabilityThe PSoC 4 HVPA-144K is now available in a compact 32-QFN (6×6 mm²) package with up to 9 GPIOs. For an easy start of development, an evaluation board is also available. Further information can be found at www.infineon.com/psochvpa144k.

The post Infineon introduces PSoC 4 HVPA-144K microcontroller for automotive battery management systems appeared first on ELE Times.

BluGlass highlights progress in March quarter

Why Synopsys wants to sell its application security testing business

Nearly a month after Synopsys snapped security IP supplier Intrinsic ID, the Silicon Valley-based firm is reported to have reached closer to selling its software integrity group (SIG), which specializes in application security testing for software developers.

A Reuters report published last week claims that a private equity consortium led by Clearlake Capital and Francisco Partners is in advanced talks to acquire the SIG unit for more than $2 billion, and the deal is anticipated to be announced as early as this week. Synopsys telegraphed the intention to divest its security software business late last year.

The acquisition as well as divesture activities have a strong imprint of Sassine Ghazi’s vision for the company’s future roadmap. Source: Yahoo Finance

Synopsys CEO Sassine Ghazi told the press in March 2024 that around three dozen buyers had shown interest in the SIG unit, and the company was narrowing down the list of potential suitors to half a dozen. Synopsys board has already approved the initiation process for the sale of the SIG unit.

Synopsys has significantly grown its application security test business after acquiring software testing firm Coverity in 2014. Next year, it scooped software security vendor Codenomicon, followed by the acquisition of open-source security vendor Black Duck Software in December 2017.

In June 2021, Synopsys snapped application security risk management firm Code Dx, and a year later, it acquired WhiteHat Security to offer automated protection for web applications in production environments. So, while Synopsys has significantly grown its application security testing business over the years and is one of the key players in this market, why does it want to sell it now?

First, it’s a highly competitive market, and Synopsys has seen its profit margins steadily decline over the past years. Second, and more importantly, Synopsys is streamlining its focus on EDA and IP businesses, so a move away from the application software business seems logical in that context.

A few months before acquiring Intrinsic ID’s IP business for physical unclonable function (PUF) incorporated into system-on-chip (SoC) designs for security capabilities like identification, Synopsys made waves by buying Ansys, an EDA outfit hyper-focused on simulation software. This acquisition is expected to extend Synopsys’ core EDA business into several growing adjacent markets.

When Synopsys made the Ansys and Intrinsic ID acquisitions in a quarter, there were vibes that this EDA firm was on way to become an industry giant. However, the news about the SIG unit’s potential sale shows that the $79 billion company has a well-thought-out plan in which EDA and IP businesses will likely define its future roadmap.

“We believe there’s a higher return on investment in the 90% of our portfolio spread between the design automation and design IP business segments,” Ghazi told investors in November 2023. The company’s software service businesses, like application security testing, clearly fall in the remaining 10%, and buyout firms will be having a closer look at such businesses in 2024.

Related Content

- Synopsys plus Ansys: The making of an EDA giant?

- Exclusive: Sassine Ghazi on the launch of Synopsys.ai

- embedded diary: Synopsys to acquire Ansys for $35 billion

- Synopsys Acquires RISC-V Processor Simulation Tools Firm

- Synopsys Adds AI-Driven Tools, Acquires PUF Security Firm

The post Why Synopsys wants to sell its application security testing business appeared first on EDN.

finished 1 half of my symetrical power supply project

| for the positive voltage rail its an lm317 regulator with a bd912 transistor and for the negative rail its going to be a bd911 transistor with an lm337 regulator. i heard using regulators for audio amplifiers is pointless but also not since it may remove oscilations and hum,get rid of expensive 4,7mF(or bigger) capacitors as well as give me a stable +/-20V regardless the current which may be usefull. [link] [comments] |

Common-Mode Chokes: From Working Principles to Important Performance Parameters

Breadboard by Nothing!!

| submitted by /u/Screen_sLaYeR_ [link] [comments] |

May the 4th Be With You - an original classic: Imperial March played from/with/as two floppy drives.

| submitted by /u/Oz_of_Three [link] [comments] |

i was bored so i made this

| motor speed controller from random parts on my desk [link] [comments] |

Starting a family

| I am starting a family or a addiction 😅 -The arduino nano with the led is a tv b gone -the orange thing is a m5stickc plus2 -the usb purple thing is a cjmcu badusb -and the white thing is a flipper zero with external antenna [link] [comments] |

Weekly discussion, complaint, and rant thread

Open to anything, including discussions, complaints, and rants.

Sub rules do not apply, so don't bother reporting incivility, off-topic, or spam.

Reddit-wide rules do apply.

To see the newest posts, sort the comments by "new" (instead of "best" or "top").

[link] [comments]